Our Chapter 13 Bankruptcy Lawyer Tulsa PDFs

You can keep your home or vehicle as long as you're existing on the settlements, can proceed paying after the insolvency instance, and can exempt the amount of equity you have in the residential property. Locate out what happens to vehicles in Phase 7 personal bankruptcy. Chapter 7 works extremely well for lots of people, particularly those that possess little residential property, have predominately charge card balances, clinical costs, individual financings, and various other debts that obtain erased in personal bankruptcy.

Her state's typical earnings for a bachelor is $65,000, so Helen will not pass the initial component of the Phase 7 implies test. Helen will subtract real and enabled expenditures in the second portion of the ways examination and pass if the estimation demonstrates that she does not have added funds to pay creditors.

Tulsa Bankruptcy Consultation - Truths

If you declared Chapter 7, your lender might right away gather the whole balance owed when the bankruptcy instance nearby garnishing your incomes, imposing your financial institution account, or perhaps taking property - Tulsa bankruptcy lawyer. Instead, you can use the Chapter 13 strategy to pay these financial debts off over 3 to 5 years without the danger of severe collection actions hanging over your head

By contrast, if you file for Chapter 13 bankruptcy, the financial institution will certainly leave your codebtor alone if you maintain up with your bankruptcy strategy payments and pay the financial obligation in complete.

In Phase 13 bankruptcy, you do not have to give up any type of residential or commercial property. If you have nonexempt building you can not birth to part with and can pay for to pay to maintain it, Chapter 13 personal bankruptcy may be the better choice.

The Definitive Guide to Tulsa Bankruptcy Attorney

A cramdown decreases the quantity you owe to the collateral's actual worth, so it functions excellent when you owe greater than the building is worth. However below are the catches. A cramdown doesn't apply to the home you stay in, and you need to pay the whole reduced balance via the repayment strategy.

If you marketed your house, the sales proceeds wouldn't completely pay the first home mortgage, so there 'd be nothing to pay towards the second. The 2nd would certainly qualify as a completely unsecured younger home mortgage, and you might get rid of the lien and basically the loan making use of Phase 13's lien stripping procedure - Tulsa OK bankruptcy attorney. Here are a few things filers are amazed to discover Chapter 13 insolvency and often find a bit difficult: You should finish the 3- to five-year payment plan prior to the insolvency court gets rid of any qualifying financial obligation balances unless the court lets you off the hook early for challenge reasons.

If you marketed your house, the sales proceeds wouldn't completely pay the first home mortgage, so there 'd be nothing to pay towards the second. The 2nd would certainly qualify as a completely unsecured younger home mortgage, and you might get rid of the lien and basically the loan making use of Phase 13's lien stripping procedure - Tulsa OK bankruptcy attorney. Here are a few things filers are amazed to discover Chapter 13 insolvency and often find a bit difficult: You should finish the 3- to five-year payment plan prior to the insolvency court gets rid of any qualifying financial obligation balances unless the court lets you off the hook early for challenge reasons.

5 Easy Facts About Bankruptcy Lawyer Tulsa Explained

In Phase 13 bankruptcy, you have to pay your creditors every one of your non reusable incomethe amount remaining after enabled monthly expensesfor three to 5 years. Disposable income is the amount that stays after deducting permitted bankruptcy costs from your monthly gross revenue. When you claim your deductions, you can make use of the real price of some expenses and the national and regional criteria for others, such as the allocation for food, clothing, and housing.

Or else, you will not certify.

Below, you'll discover more posts explaining how personal bankruptcy works. We wholeheartedly motivate research and learning, however online short articles can not resolve all insolvency concerns or the truths of your instance.

Rumored Buzz on Bankruptcy Attorney Tulsa

You can certify for Chapter 13 bankruptcy if you have regular earnings and your complete secured and unprotected financial debts are less than $2,750,000 (the limitation for 2024) on the day you submit for insolvency. Neither Phase 7 neither Phase 13 insists on payment of all superior financial obligations.

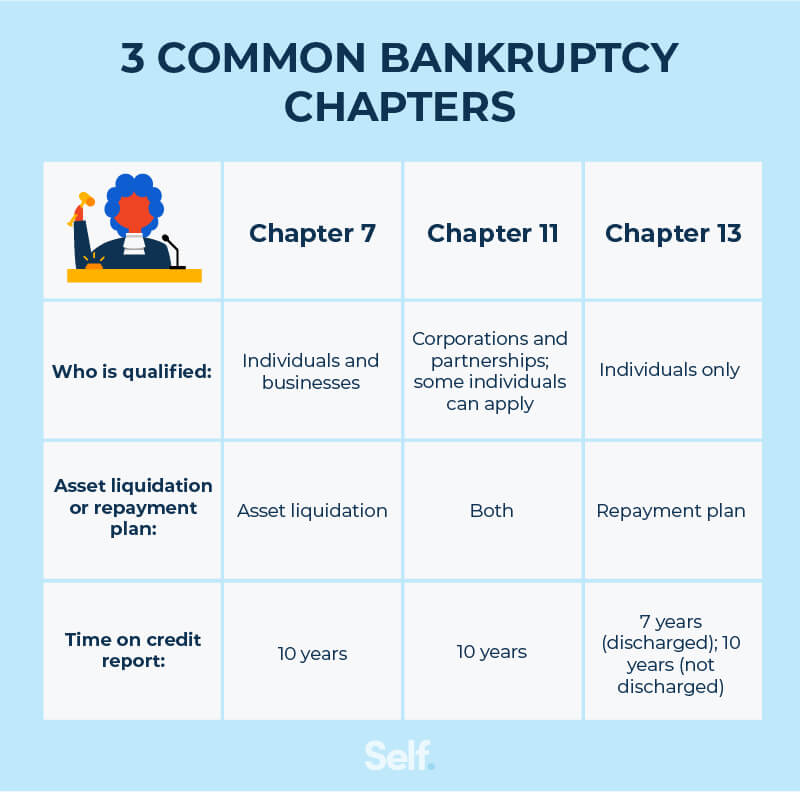

You can certify for Chapter 13 bankruptcy if you have regular earnings and your complete secured and unprotected financial debts are less than $2,750,000 (the limitation for 2024) on the day you submit for insolvency. Neither Phase 7 neither Phase 13 insists on payment of all superior financial obligations.Due to the fact that bankruptcy impacts firms really in a different way than individuals, small company owners will also wish to reference discover local business personal bankruptcy strategy. Taking a look at the highlights of Phases 7 and Chapter 13 is a great method to learn more about personal bankruptcy differences.: A Chapter 7 insolvency discharges most sorts of unsafe financial debt.

Some Of Experienced Bankruptcy Lawyer Tulsa

Petitioners with nonexempt residential or commercial property could lose it to satisfy some debts. Companies aren't qualified to keep building using exemptions. bankruptcy attorney Tulsa.: The trustee does not offer home in Chapter 13 insolvency.

Hanson & Hanson Law Firm, PLLC

Address: 4527 E 91st St, Tulsa, OK 74137, United StatesPhone: +19184090634

Click here to learn more

People whose company debts are above customer obligations or with qualifying military experience are exempt from the methods test. Organizations aren't called for to pass the ways test.: Phase 13 needs sufficient regular income to pay the amounts needed in the month-to-month settlement. You have to gain enough revenue to pay all called for amounts via the strategy.

Comments on “Not known Facts About Best Bankruptcy Attorney Tulsa”